SARAWAK PLANTATION BERHAD

|

13

|

Annual Report 2014

Message to Our Shareholders

Other Activities

Our other business segments offer valuable synergies

but currently contribute negligibly to the Group’s

revenue.

In Conclusion

The Board believes the Company’s financial

performance was satisfactory for the year in

review. As a commodity producer, our business

is cyclical in nature and we have to work within the

constraints imposed by global market factors

entirely beyond our control.

Dividends

On 27 August 2014, the Company declared a first

interim, single tier dividend of 6 sen per share,

totalling approximately RM16.8 million, in respect

of the financial year ended 31 December 2014

which was paid to shareholders on 8 October 2014.

On 24 February 2015, a second interim, single tier

dividend of 3 sen per share was declared, totalling

approximately RM8.4 million, and was paid to

shareholders on 9 April 2015.

This represents a total distribution to shareholders

of approximately RM25.2 million or 41% of the

Group's net profits for the year. The dividend yield

is 4% based on the year-end share price of

RM2.34 and in the Board's opinion offers investors

satisfactory short-term financial returns whilst

maintaining cash reserves for future growth.

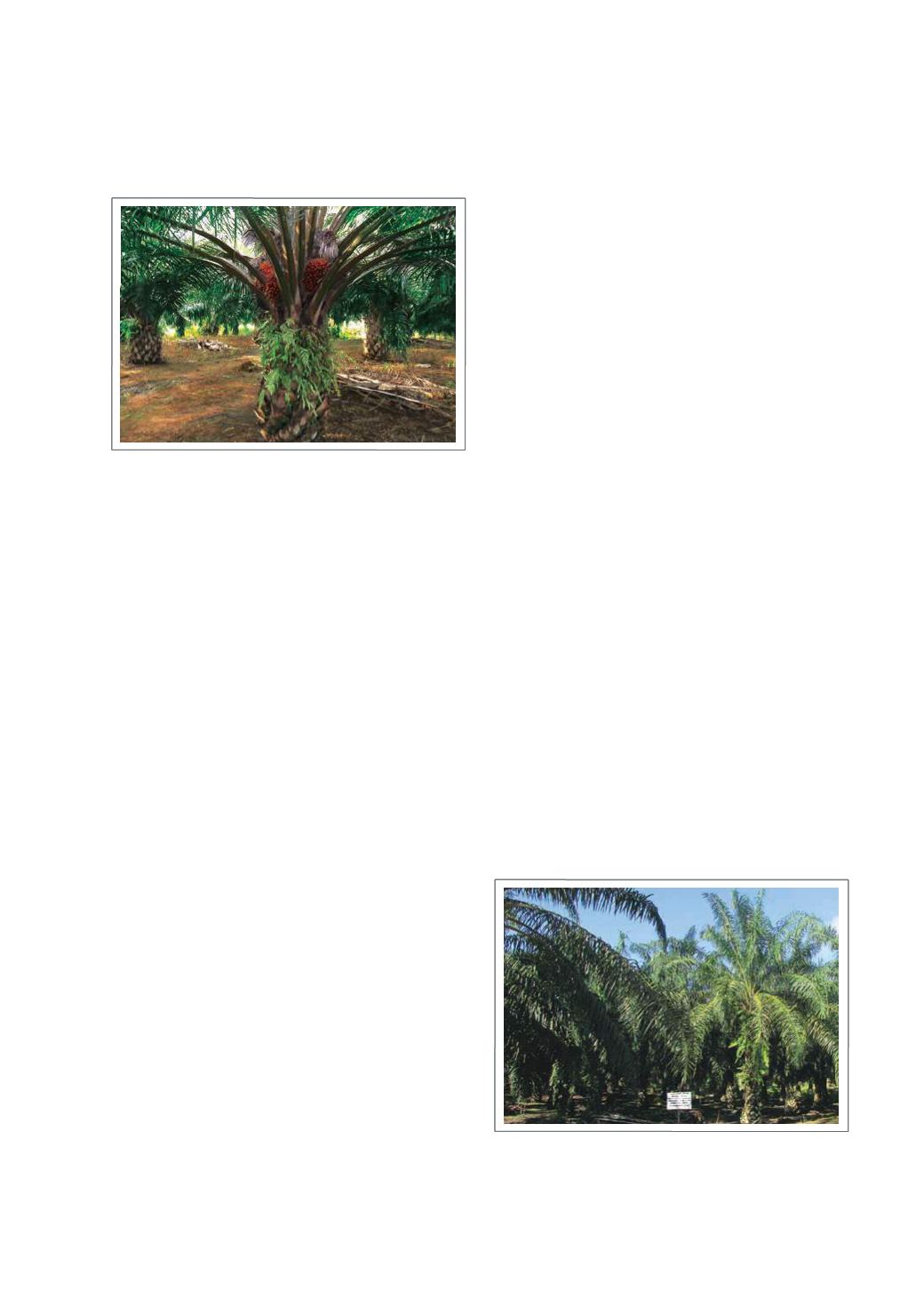

FFB Production and Yield

Production of fresh fruit bunches (FFB) from our

estates was 289,076 mt in 2014 compared to

309,218 mt in 2013, while yield was 11.60 mt

per ha in 2014 compared to 12.37 mt per ha in

2013. Lower volume was mainly due to 2014 being

a low cropping year coupled with replanting activities.

Oil extraction rate

Our oil extraction rate (OER) was 20.88% in 2014

against 20.87% in 2013 whereas kernel extraction

rate was 4.49% in 2014 compared to 4.48% in

2013, both recorded a marginal improvement.

Nevertheless, our OER was higher than Sarawak

average of 20.43%.

Increase in CPO and PK Production

Our mills recorded an increase of 3.6% in the

FFB processed from 655,401 mt in 2013 to

678,789 mt in 2014.

Output of CPO was 141,742 mt and PK was

30,493 mt, increases of 3.6% and 3.8% respectively

principally due to increase in purchases of FFB

from externel parties. This demonstrates the value

of our outsourcing policy and the effectiveness

of our quality control system for outsourced FFB.

Sales Volumes of CPO and PK

Sale volumes of CPO recorded an increase of 2%

whereas sale volume of PK decreased.